Security Mechanism

Introduction

Security is always the foremost consideration in the design of blockchain systems. Without security, any design or implementation becomes meaningless. However, the concept of security in the blockchain domain is complex, as blockchain is a combination of cryptography, computer networking, and economics. Consequently, security is manifested in multiple aspects within the blockchain. Wanchain 5.0 relies on the Storeman group to provide cross-chain functionality, including locking cross-chain assets and verifying cross-chain information. Therefore, the security of the cross-chain mechanism can be simplified to the security of the Storeman group. In the remainder of this article, we demonstrate how Wanchain 5.0 ensures the security of the Storeman group from both cryptographic and economic perspectives.

Cryptography

A distributed randomness generation algorithm with provable security -SecRand

Storeman nodes, also known as cross-chain nodes, are chosen through a community selection process. Every 25 Storeman nodes form a group and build a cross-chain bridge. In two specified WAN Bridges between two public chains (e.g., to build 10 Wanchain-Ethereum bridges, a total of 10 Storeman groups with 210 Storeman nodes are needed), the grouping results of all involved Storeman nodes directly affect cross-chain security. For instance, if all Storeman nodes controlled by an adversary are assigned to the same group, there is a high probability that the secret will be reconstructed, and the locked assets will be stolen. Thus, the grouping result must satisfy unpredictability and bias-resistance. Unpredictability ensures that the adversary cannot predict the grouping result and execute a targeted attack. Bias-resistance ensures the adversary cannot influence the grouping result to their advantage. Wanchain 5.0 uses a random number as the input for the grouping algorithm to achieve unpredictability and bias-resistance. The random number is generated by SecRand, a distributed randomness generation algorithm with provable security that provides high-quality entropy in the grouping process.

Threshold Optimal TSS scheme

Most cross-chain projects use TSS schemes that are not threshold-optimal, which increases the risk of collusion, as explained in the article "Wanchain 5.0 Cryptographic Foundation". With a fixed threshold, a non-threshold-optimal TSS scheme requires distributing the secret key to about twice the threshold nodes. For example, if the threshold is 5, a total of 9 nodes are needed to complete the threshold signature in non-threshold-optimal TSS schemes, whereas only 5 nodes are needed in threshold-optimal TSS schemes. Clearly, the probability of collusion among 5 out of 9 nodes is higher than that of 5 out of 5 nodes. Therefore, Wanchain 5.0 employs a threshold-optimal TSS scheme to increase the difficulty of collusion and ensure the security of assets in locked accounts.

Publicly verifiable exchanged data

Wanchain 5.0 enhances Shamir's secret sharing used in the TSS scheme to Feldman secret sharing, ensuring that exchanged data between Storeman nodes are publicly verifiable. As a result, malicious Storeman nodes that send invalid data during the TSS scheme will be filtered out. The invalid data will not be used in signature reconstruction and will not affect the signing process. Finally, the malicious Storeman node will be penalized for their malicious behavior.

Economy

Scientific deposit mechanism

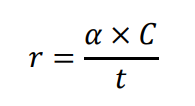

Deposits increase the cost of malicious behavior for Storeman nodes and reduce the motivation to act maliciously. The higher the deposits, the more secure the cross-chain assets are. However, excessive deposits raise the "participation threshold", which may lead to most Storeman nodes being controlled by wealthy individuals. The deposit calculation formula in Wanchain 5.0 is shown below:

where C is the capacity of the bridge (The capacity of the bridge refers to a reasonable maximum amount threshold at which Storeman nodes still don’t have the motivation to directly give up the deposits and take the cross-chain assets for profits because the cross-chain assets value in total is equal or less than the deposits value when this capacity hits. ), t is the threshold in TSS scheme, r is the amount of required deposits, α is the adjustment factor and is bigger than 1. Obviously, the cost of stealing the assets in the locked account is r x t, which equals to α x C. With α>1, the adversary’s profit C is always less than its cost α x C.

A Comprehensive Incentive Mechanism

Wanchain 5.0 offers a comprehensive incentive mechanism to ensure Storeman nodes strictly follow the protocol. Specifically, good behaviors will be rewarded, and malicious behaviors will be punished. Under the assumption of rationality, Storeman nodes will act honestly to maximize their reward.

A Falling-Price Auction

Even there is little chance that the assets in the locked account is stolen, we still provide a solution for this extreme case — a falling-price auction, which is used to pay the users for their lost assets in the locked account. Once the assets in the locked account are moved Illegally, then all Storeman nodes’ deposits will be locked and will not be returned to their accounts after the working cycle. These deposits will be sold through a falling-price auction, and the money will be used to pay the users who have assets in the locked account. Due to the adjustment factor α, the deposits are always enough to pay user’s loss. The remainder will be rewarded to the person who triggers this mechanism. So anyone can audit behaviors of the Storeman nodes.

Last updated