Overview: Crosschain DeFi

Wanchain is quite fond of using the metaphor of Wide Area Networks vs Local Area Networks (“WAN vs LAN”), to describe the incredible potential which will be unleashed when the crypto industry’s currently mostly isolated blockchains and their assets finally become connected. In the early days of the internet, knowledge was siloed in local university and library LAN networks. The advent of WAN, which connected all of those local networks in order to form the incredible network of knowledge and data which is the internet as everyone knows it today, unleashed an incredible torrent of creativity, new businesses, new financial opportunities, even entirely new cultures and ways of life. It is in fact from this metaphor that Wanchain takes its name — WAN+chain.

Wanchain’s goal is to unleash the incredible power of connectivity by building the infrastructure for the universal connection of all blockchains and their assets. What WAN networks did for data and knowledge, Wanchain predicts their cross-chain infrastructure will do for decentralized financial applications (DeFi).

For the past several years Wanchain has been building the infrastructure to power cross-chain DeFi use cases in a decentralized and trustless way. Their ultimate goal is not ONLY to connect various blockchains and digital assets together, but also to connect the world of decentralized finance together with traditional finance and assets. This new world where value flows freely from blockchain to blockchain, and between DeFi and traditional ecosystems, and where trustless applications can be built to take advantage of all this different interoperable value, Wanchain believes will be just as revolutionary a step forward as the introduction of the global Internet.

Lack of Standardization Leads to “Value Islands”

As unglamorous and dry as rules and standards may seem at first, there is a certain magic to them which gives them great transformative power. There have been countless examples of the power of standardization over and over through history.

In 221 BC, the Chinese Emperor Qin Shihuang conquered his six neighboring nations to establish the Qin Dynasty. After firmly establishing his rule, Emperor Qin set about enforcing the standardization of currency, weights, measures, the transport system and the writing system.

Prior to Emperor Qin’s enforcement of standards, each local area had their own individual standard, and some places would even mix multiple standards together! Take, for example, the seemingly simple and rudimentary technology of horse carriage tracks. These were not the modern roads or cast iron train tracks of later years, but were rather simply furrows set in the earth at a set width apart. Before the unification of the Qin Dynasty, the width of the carriages used by the six nations was different from each other, resulting in different widths of tracks throughout the region. Therefore, it was extremely inconvenient for the carriages to go from one country to another. After standardizing the transport system, goods could be transported from one place to another more efficiently and conveniently, which allowed for the entire domain that used the shared track standard to share in the economic benefits of unifying the transport standard of the region.

The situation of track widths prior to the Qin dynasty is mirrored in the world of blockchain today. There are countless different public chains, consortium chains, and private chains. Each has their own different underlying frameworks, data structures, and APIs. Therefore, connecting one chain with another chain, especially for heterogeneous chains (those with significantly different technical infrastructure), is a major challenge.

The Phenomena of Value Islands Limits the Potential of DeFi

Due to the lack of standards, the phenomena of “value islands” has arisen. Value islands refer to the different assets and applications which operate on various different blockchains, and cannot easily connect with other different chains. The most obvious example of this value isolation is, of course, that of Ethereum. While it is true that a number of real world assets and assets from other chains have been issued on Ethereum through a variety of mechanisms with different levels of security and decentralization, the value island problem is still very severe. Only a select few assets are able to find their way to Ethereum from elsewhere, with USD stablecoins and BTC pegged or backed tokens being the most prominent of these. Aside from these few assets, next to none are able to find their way onto Ethereum. Not only is it difficult for value to get onto the Ethereum island, it’s just as difficult for it to leave! While there may currently be some experimental solutions for bringing ETH to other chains, none are currently widely used or accepted.

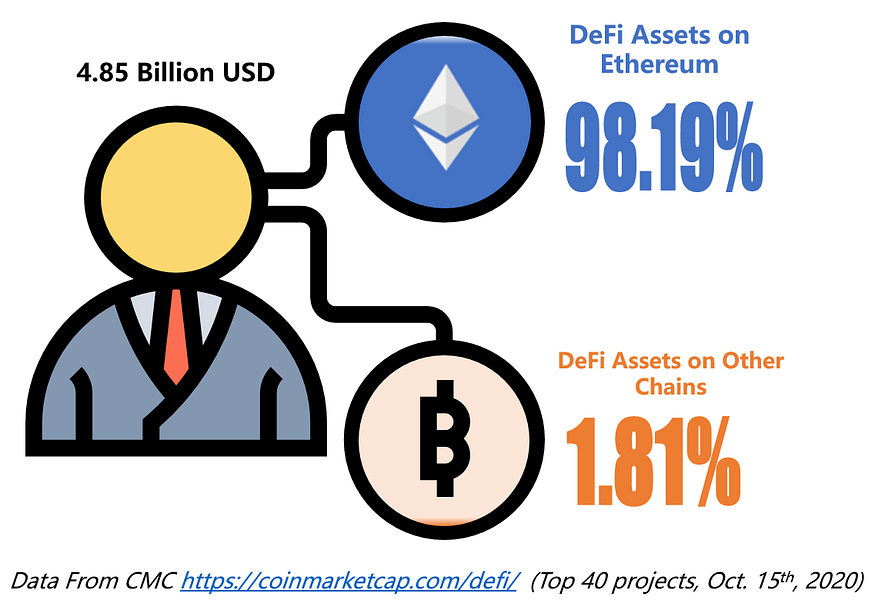

This innovation vacuum brings the crypto space to the peculiarly lopsided DeFi market that has evolved today. The DeFi ecosystem in the public chains represented by Ethereum is prosperous, while the DeFi ecosystem in other public chains are cared for by few people. Wanchain has counted the top 40 DeFi projects on CoinMarketcap. You may get a general whole picture of DeFi world from those top 40 DeFi projects.

Billions of dollars worth of assets are trapped on other blockchains, unable to participate in the recent DeFi boom on Ethereum.

WanBridge — Wanchain’s Decentralized, Universal Solution for Trustless and Permissionless Cross-chain Value Transfer

Since Wanchain published their whitepaper over 3 years ago, their focus has stayed set on building infrastructure for cross-chain value transfer in order to enable new decentralized financial use cases. After years of intense research and development, engineering breakthroughs, and lots of blood, sweat, and tears, the Wanchain team is about to unveil the product that realizes many of the primary goals which were laid out in their original whitepaper — The WAN Bridge.

The introduction of WAN Bridges allows for assets to begin to flow freely between different heterogeneous blockchains, despite the lack of standardized blockchain infrastructure.

WanBridge Development History

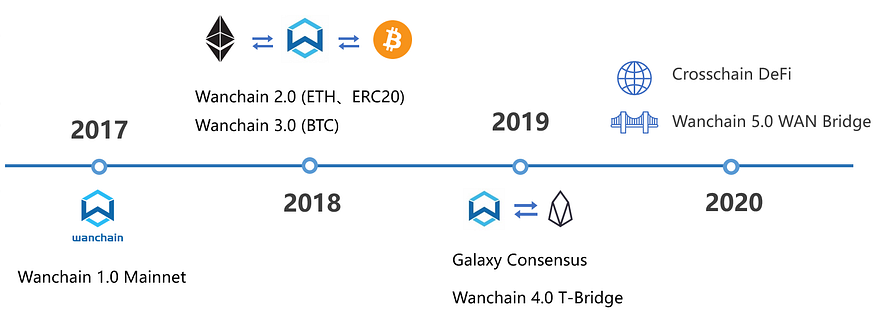

In 2018, Wanchain successfully implemented a cross-chain value transfer solution which allowed BTC, ETH and ERC20 tokens to move back and forth from their native chain to Wanchain. In 2019, Wanchain integrated with EOS and proposed a universal cross-chain framework protocol T-Bridge for cross-chain integration with consortium chains.

2020 brought along Wanchain 5.0 and the WAN Bridge. The WAN Bridge is a major step forward from Wanchain’s previous cross-chain implementations in practically every important dimension including decentralization, trustlessness, and security. Most prominent of these advances is that WAN Bridges are universal which means they allow for the transfer of value back and forth between any two connected chains.

WAN Bridge is the core product of Wanchain 5.0, and is a major upgrade based from our previous cross-chain mechanism. It is an affordable and scalable solution which allows for native assets and tokens to flow securely and rapidly back and forth between ANY two chains connected by a bridge.

First Ethereum…and then the World!

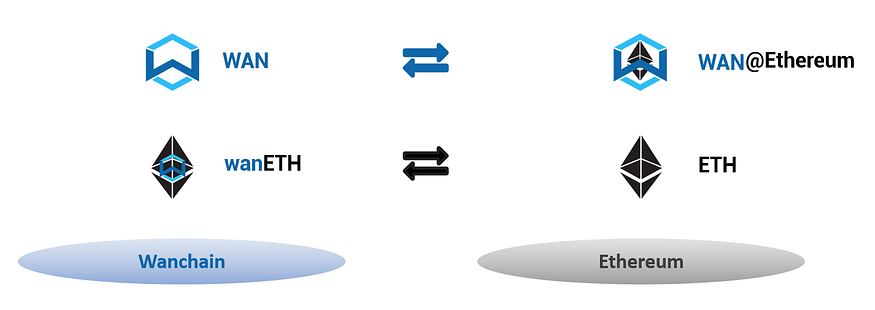

As each pair of chains to be connected requires its own bridge, WAN Bridges will be set up one by one after the launch of Wanchain 5.0, starting with the most prominent public blockchains, and eventually expanding to include a large array of popular public blockchains. Naturally, the first bridge to be set up will connect Wanchain with Ethereum. Through this bridge, Wanchain’s native WAN and WRC20 tokens may travel back and forth between Wanchain and Ethereum. Likewise, the bridge also allows for ETH and ERC20 tokens to flow freely back and forth between the two chains.

A Note on Nomenclature:

One of the unique challenges brought by cross-chain asset transfer is that of taxonomy. As more and more tokens become available on more and more different chains, the problem arises of how to refer to the various cross-chain formats of the same asset. Wanchain has proposed their own nomenclature for cross-chain tokens using the @ symbol and lowercase token symbol prefixes.

“@” nomenclature:

The “@” symbol is used to specify which blockchain a token currently resides on. For example, WAN@Ethereum refers to the ERC20 version of the native WAN asset which has been issued on Ethereum.

Lower case token symbol prefix nomenclature:

This nomenclature is used to specify which service provider has issued a cross-chain token. For example, wanETH refers to the native ETH asset which has been issued as a wrapped token by Wanchain. It DOES NOT specify which chain the token resides on. In order to do that, you would need to combine the nomenclatures. For example, wanETH@Wanchain refers to tokens on Wanchain, while wanETH@EOS would refer to the same underlying tokens, only now on the EOS blockchain.

Regarding the naming rules of cross-chain assets, Wanchain will have a more in depth discussion in future articles.

Wanchain 5.0 Cross-chain System’s Foundational Concepts:

Roles

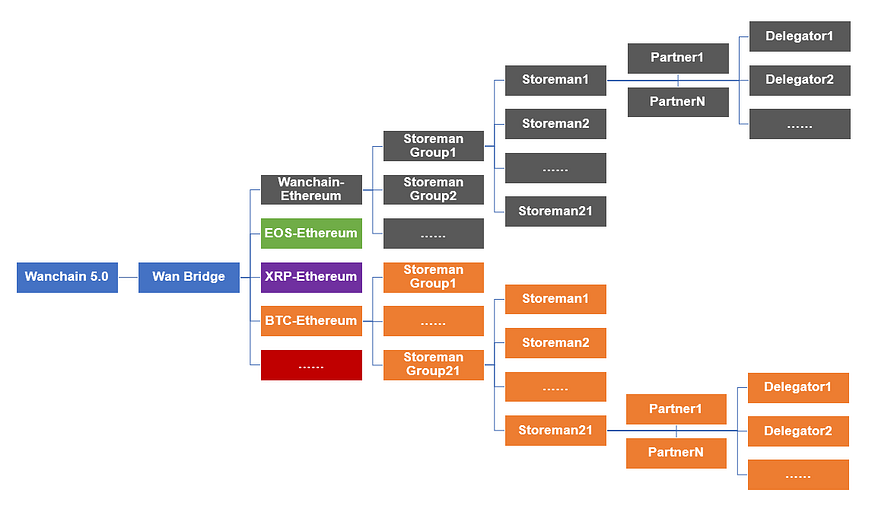

Wanchain 5.0’s Cross-chain system includes a variety of different actors who fill different roles in the system. Below is a diagram summarizing the different roles:

Wanchain will be releasing more articles exploring the various roles and functions at a later stage

Cross-chain value transfer core mechanism

Wanchain’s cross-chain approach is to set up one or more decentralized WAN Bridges in order to connect blockchain pairs. Each Wan Bridge has a Storeman Group consisting of 21 Storeman Nodes (nodes that manage the cross-chain value transfer process).

Security Mechanism

In order to ensure the safe and stable operation of the entire cross-chain system, Storeman Node operators must pledge a certain amount of collateral to be put up as stake. Meanwhile, node operators can also attract deposits from partners and delegators to increase their total stake and obtain more rewards during node operation.

Future articles will cover staking, delegation, and the rewards from each in greater depth.

WAN Bridges uses a threshold signature scheme combined with multiparty computation (TSS + MPC) in order to guarantee the security of the locked assets and the smooth functioning of the cross-chain value transfer system.

Cryptoeconomic incentives are also used to guard against malicious behavior. Node operators are required to over-collateralize the value of the cross-chain assets they issue. In cases of malicious behavior, that collateral may be slashed. In this way, the cost of malicious behavior is greater than the rewards set to be gained by it, so Wanchain can ensure that node operators are always incentivized to behave honestly.

Wanchain will release a future article explaining incentives and slashing in greater detail.

Wanchain 5.0 Highlights

WAN Bridges are Wanchain’s decentralized, universal solution for trustless and permissionless cross-chain value transfer.

BTC, EOS, WAN, and more will be brought to Ethereum, and Ethereum assets will brought to Wanchain.

The first decentralized cross-chain bridge will be from EOS to Ethereum.

Where Wanchain goes from here…

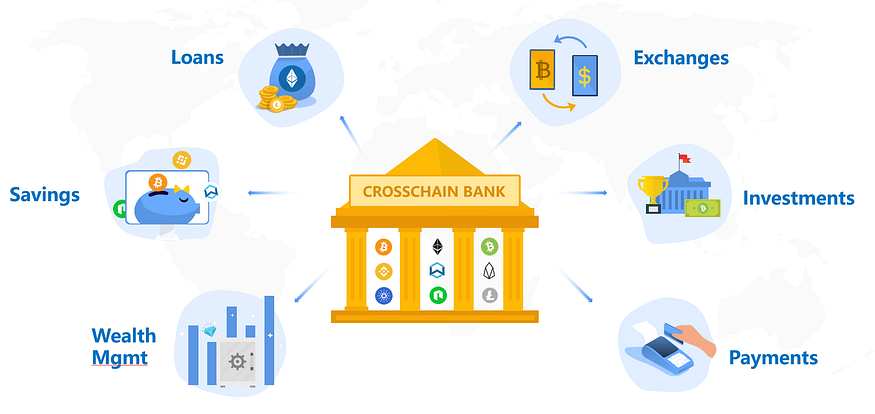

Wanchain’s long term goal is the establishment of a distributed cross-chain bank which will provide global users with a one-stop shop that offers a variety of decentralized financial products to fulfill all their needs.

Wanchain’s long term goals will be discussed in greater depth in a future article.

Wanchain looks forward to these next few months as they have been preparing for this moment since they first combined blockchain technology with the concept of the Wide Area Network (WAN) to form WANchain.

Last updated